In August 2020, the Government suspended payment of the HGV levy until August 2023. It had been in place since 2014 for heavy goods vehicles over 12 tonnes gvw.

The Government intends to re-commence payment of the levy from August 2023. And, when it does so, it intends to either change its format or keep it as before.

If the basis of the levy is changed, it will be based on the vehicle’s environmental performance. The Department for Transport (DfT) suggests that, in this scenario, most operators would pay the same or less, with only a small number facing a higher amount of levy.

At the point the levy was suspended (August 2020), there were no fewer than eleven payment bands each divided into two depending on the HGV’s emissions class. In 2019, the Government had changed the criteria for the original levy to base this on EURO emissions.

The Government wants to base the revised levy on Co2 emissions and environmental quality performance. There is seemingly no method of establishing Co2 emissions on HGVs – hence, the Government would intend to reform the levy to be based on vehicle weight, as there is said to be a broad link between weight and Co2 emissions.

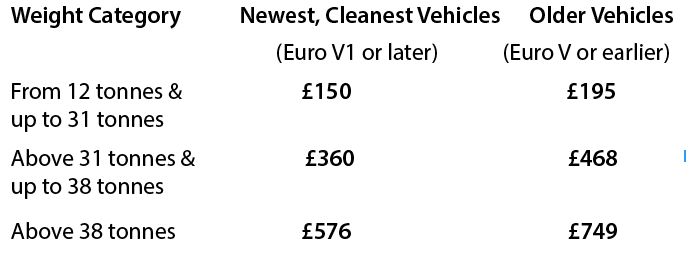

Any reformed levy would also simply be based on two criteria: the vehicle weight and pollutants (the EURO emissions class) and there would only be six levy bands (3 divided into 2 each). This would mark a change from the existing levy that has been based on vehicle type, number of axles, vehicle weight and pollutants (Euro emissions class).

The proposals published by DfT would lead to reformed levy charges as follows:-

This would apply to rigid HGVs, articulated HGVs and rigid HGVs pulling trailers. Rigid HGVs pulling trailers of 4 tonnes or more would pay on the basis of the total combination weight, to determine the calculate the correct band and amount of levy.

The DfT has issued consultation documentation, seeking views for these proposals and the retention of the status quo. If the current levy rates were retained, then hauliers would pay what they paid before, whilst reform would mean them paying the same or less, with a small proportion potentially paying more.

Foreign vehicles: here, the Government intends to continue the levy, but only to charge foreign HGVs when using main roads i.e. A-roads or motorways. Further, it is intended that foreign HGVs only pay the levy on days (or part of days) when an HGV is driven on a road – not when used or kept on a road.

The consultation is open until 18th July 2022. The levy will resume in August 2023, whatever its outcome. Given any increase will affect few hauliers and most will be no worse off or benefit from lower amounts, it appears likely that reform will be implemented. The DfT believes that there will be little adverse impact for those hauliers that might see any increase in levy, as the levy represents only a small proportion of overall HGV operating costs. Whether that is a view shared by all in the road transport sector, remains to be seen.

Ashtons Legal advice and representation

If you require any advice with regard to Goods and Passenger Operator Licencing, including advice concerning DVSA Investigations, correspondence with the Office of The Traffic Commissioner or Traffic Commissioner Preliminary Hearing/Public Inquiry work, then please get in touch.

Contact: Tim Ridyard, Partner Transport and Regulatory T: 01284 732111